I’ve been fascinated with investing since the moment I learned about passive income and compounding asset growth. It’s a journey I’m still on, and something that excites me every day.

I’ve been fascinated with investing since the moment I learned about passive income and compounding asset growth. It’s a journey I’m still on, and something that excites me every day.

In this blog post I hope to share some valuable insights with you and give you a high level look at the wealth building system I use today. I’ll share examples of how you can get started with a solid wealth building plan, even if you’ve got no money available to invest (that’s the situation I was in when I started out). Make sure you also download the ‘Wealth Building Blueprint Pack’ (see link below) and the Infographic (PDF format) at the end of the post.

Around 2002-2003 I started to take investing seriously and began to actively build my own investment portfolio, and build a blueprint that I’m still using today. What you’re about to see is a simple plan that continues to evolve as I continue to learn, and as my investment needs change.

My wealth blueprint has worked incredibly well for me. It’s something that can get tangible results in the short term regardless of what your investment power may be today, while also being VERY scalable.

The exact wealth blueprint you’re about to see has built me an 8-figure portfolio that continues to grow rapidly year on year, and is very much on auto-pilot.

As you’re about to see, my Wealth Blueprint is simple, and it works. This is the first time I’ve shared it with anyone, I really hope you enjoy it and I encourage you to take action.

IMPORTANT: You do NOT need money to start using this plan.

If you don’t have disposable savings to invest on day 1, that’s FINE, that’s the same situation I was in. I didn’t have a dime to my name when I got started. If this is the situation you’re in, then ‘step 1’ in your plan will be to figure out a way to make some extra money. I’ll share some simple ideas about how you can build a $50,000+/year profit income around this shortly.

Before we dive in, let me stress a few points:

- Although what I’m sharing works well for me, you shouldn’t take this as financial advice. I’m not qualified to give financial advice.

- Everyone’s investment plan should vary because everyone has different goals, combined with different ages, combined with different geographic locations and more. What I’m sharing is a framework that I hope you’ll be able to adapt to your own needs.

- I don’t consider myself an investment guru but rather a perpetual student of the game. I don’t have special academic knowledge of the finer details of investing, but as you’ll soon see, with the plan I follow, a basic understanding of the components is all you need.

- I’m deliberately only sharing high-level details and ignoring going down any rabbit holes that’ll only result in more questions than answers… I don’t want to scare you off, but rather enlighten you to a new wealth building approach which you can then dive deeper into on your own.

- It’s never too late to start. You would be amazed at how quickly my Wealth Blueprint can deliver exciting results.

Let’s dive in!

Five Key Parts

My Wealth Building plan has five key areas, each is important for different reasons as we’ll explore shortly:

- The Mint (a way to make money)

- Piggy Bank (a simple, low-risk, ‘hands off’ way to invest your money)

- Casino (a high-risk / high-return investment plan)

- Parachute (a safety net)

- Foundation (a structure to support your wealth, taking care of tax, legal, admin etc)

The fuel for the Wealth Building machine is money, and we make that in ‘The Mint’, so that’s the logical place to begin this journey.

1. The Mint

To build wealth you need to make money.

It doesn’t really matter how you make your money, but the faster you can make your money, the faster your wealth will build on its own (common sense!).

Harnessing the power of compounding is how your wealth will build on complete autopilot, and the more dollars you have in your system, the more your wealth will grow.

I’ll share a tool with you shortly that you can plug your own numbers into and run different projections, and you’ll see how small increases in how much you inject can massively impact how quickly your wealth builds.

The first part of the wealth building system I use is called The Mint, and it focuses on generating cash that you can invest.

Your Mint could be your day-job, your own business, a new ‘side-gig’, inheritance, proceeds from something you’ve sold, or anything that gives you money that you can then inject into your system.

As a serial entrepreneur in the online space, and having taught tens of thousands of people globally about building online businesses, I know from experience that there isn’t a better, faster or more scalable way to build an income than through leveraging an online business. If you want to generate more cash, online businesses are the best way to do it.

How much cash does your Mint need to generate?

The wealth building system I use will work for any amount you invest (even just a few thousand dollars per year), but as mentioned above, the more you can add into your system, the faster your wealth will grow on autopilot.

I think a good initial aim is to inject $20,000/year, and eventually build up to $100,000/year. It took me a few years before I was investing at a rate of $100k+ per year, and probably 18 months until I was able to invest my first $20k, so don’t worry if you don’t have much money available on day one (most people don’t!). The idea here is that to be able to build great wealth, you need to first be able to generate cash, and The Mint is where you’ll do this.

Earning $100,000 profit per year from an online business is something anyone can do, and it’s something you can build towards over your first year very realistically.

My Mint (in my case, my Mint is my various online businesses) mainly consists of:

- Physical product brands that I own

– Sold online (Amazon.com, our own stores)

– Sold offline (main street retail such as Walgreens, CVS, etc) - Dropship eCommerce stores

- Wholesale eCommerce

- An affiliate marketing business

- An education business

– Coaching & consulting

– Group training programs - A hosting company

- Several software companies

These businesses provide my ‘bread and butter’ income and it’s where my investment cash comes from.

Your Mint might be a combination of a day-job that earns you $50,000 per year and a new online business that makes an additional $30,000 per year… of that combined income, perhaps you can save $10,000 to invest.

Or maybe you’ve got a day-job that earns you $70,000 per year and a room in your house that doubles up as an AirBnB accommodation unit making you an additional $10,000 per year. Of that $80,000, perhaps there’s $15,000 you can invest.

Or maybe you’ve JUST got your day-job income and you’re going to use that to fund your investments… and that’s absolutely fine. Whatever you’re doing, if you can get more money coming in, the other components we’re about to discuss will be exponentially more powerful.

If you don’t have money to invest, then you need to find some. There are lots of ways to make money from online businesses. My current favorites are:

- Dropshipping Via Your Own eCommerce Stores

- Selling Your Own Brands Of Physical Products On Amazon.com

- Selling Other People’s Products Using Affiliate Marketing

- Providing Online Marketing Services To Local Businesses

- Digital Product Creation

Here’s a high level overview of each:

Dropshipping Via Your Own eCommerce Stores

This is the business model that we’ve been focusing on teaching for the past couple of years via our ‘Kibo Code’ training program.

In a nutshell, you set up your own eCommerce store and sell physical products on it. You don’t own the products you sell, and you only buy them from your supplier AFTER you’ve actually sold them, meaning this is a cash-flow friendly business model.

With the surge in online shopping, this type of store and business model works better than ever before.

Selling Your Own Brands Of Physical Products On Amazon.com

This is where you create products of your own under your own brand name and then sell them through the Amazon.com ecosystem.

For example, you could create a product line of five different complementary products (perhaps five different DSLR camera cases). You ship them in to Amazon, and people find them and buy them on Amazon. Amazon handles the shipping to the customer and receives the money for your products. Amazon then pays you your share of the sale revenue (sell price minus Amazon fees).

Not only do we sell our brands on Amazon.com (USA), we sell them all over the world and in thousands of brick-and-mortar (offline) stores as well.

We love this business model because its proven itself to be very stable, reliable and lucrative since we started it over a decade ago.

Selling Other People’s Products Using Affiliate Marketing

There is huge demand for information that solves people’s problems and allows them to improve their lives. As an affiliate you can earn a commission by selling products developed by other people. This is known as ‘affiliate marketing’.

For instance:

- You could sell an eBook about the Paleo diet for $100, and make a $50 commission.

- You could sell a digitally delivered training course about Public Speaking for $250 and earn a commission on the price (often up to 70%!).

- You could sell marketing software that may have a recurring price of $50/month, and make recurring commissions for many many months (or even years).

The beauty of Affiliate Marketing (much like dropshipping other people’s physical products) is that you don’t need to create any product of your own. This reduces the barrier to entry for many online entrepreneurs. There are tens of thousands (probably hundreds of thousands) of products that you can sell as an affiliate.

Providing Online Marketing Services To Local Businesses

Unlike the three options explained so far, providing online marketing services to local businesses is a service business. It’s where you get paid money to provide marketing solutions to local businesses who might hire you for Search Engine Optimization, Social Media Management, Website Design, Hosting, or any other digital service that local businesses need.

The margins for providing these kinds of services can be very high, and a single sale can result in thousands of dollars profit (often recurring month after month).

We love this market segment (local businesses) so much that we’ve expanded beyond the delivery of services for these businesses and have an entire software company dedicated to providing marketing solutions to local businesses through software.

Digital Product Creation

The fifth business model I’d recommend to people who want to build an online income stream is digital product creation. This is where you create some kind of info-product of your own, and sell it (and get affiliates on board to sell it for you as well).

Digital product creation normally takes a little longer and costs more money to get up and running compared to the other four options shared above, but the rewards can be massive. Due to the digital nature of these products, the ongoing overhead can be very very low, meaning high profit margins.

The bottom line is this: any one of these five business models could be used to generate a $100,000 per year profit business, which could rapidly fuel your wealth building machine.

Once you’ve got money available to invest, the next step in my wealth blueprint is to actually invest it. That’s where the ‘Piggy Bank’ comes into play…

2. The Piggy Bank

The Piggy Bank is the second piece of the Wealth Building machine and represents simple, low-risk, ‘hands off’ ways to invest your money (the money you’ve made in the first piece of the plan, The Mint).

Your Piggy Bank is the first of two places where your wealth will grow on its own (the second being ‘The Casino’, which we’ll discuss shortly). The Piggy Bank should give you an income stream and also grow in value (appreciate in value). This is the place I like to put the vast majority of the ‘extra’ cash I have available (what I have left over after living costs).

My Piggy Bank is made up of just two investment strategies (and my money is split pretty evenly between each of these investment strategies):

- Property Investments

- Stock Investments

NOTE: There are multiple layers to Property and Stock investments, multiple ways to diversify, and I’ll talk more about these in section 4 (The Parachute).

I deliberately keep the way I run my Property and Stock investments as simple as possible.

The Mint is where I spend my time generating income. That’s my main money-maker, so I want to make sure that my time is used wisely here. I do NOT want my time to be used through investment admin, which is why I need the Piggy Bank to be simple.

If my Piggy Bank investments become time intensive to manage, then the investment will actually be counterproductive and HURT my wealth building by reducing what I can earn through The Mint (because I’ll be distracted from my main income generating activities).

Everything in my Piggy Bank is geared towards simplicity and needs to be as close to hands-off as possible.

1. Property Investment

Property is how my Wealth Building journey began.

I bought my first property in Argentina in 2006. I was 23 years old at the time and had no property investment experience at all, and I sure as hell didn’t know much about buying property in South America!

TIP: Buy your first property in a place where you speak the language and understand a little about the process, do NOT do what I did!

I dived into the deep end and got on the property ladder. My first property was a dump. It cost me about $32,000. I paid for it in cash over a table in a grimey bank, where every $100 bill was scrutinized, and many rejected (which is a whole other story).

Here’s a photo of me standing in my first property shortly after buying it:

My first property showed me the power of living rent free, but also in earning passive income through renting.

In 2008 I purchased my second property, this time in Auckland, New Zealand, and this time I was able to leverage a 50% mortgage, meaning I was now using other people’s money to build my wealth.

Fast forward to today, and I own dozens of investment properties throughout New Zealand, the USA, and Argentina.

The properties I own are diversified in nature (type of property, location, type of tenant, etc), but they ALL meet two criteria:

Criteria #1) They provide me with cash flow through rental income

Criteria #2) They appreciate in value

Criteria #2 is a little harder to control as properties tend to rise and fall in value depending on market cycles and lots of other variables, but by buying the right kinds of property in the right places, you can mitigate a lot of the risk of price downturns.

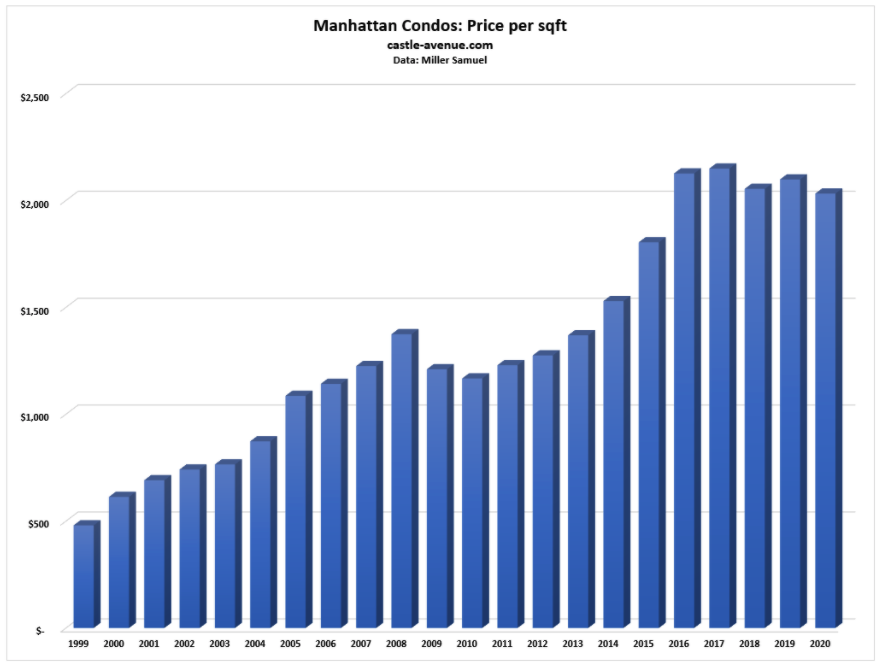

For example, one of the reasons I invest in Manhattan, NYC, is because property value very rarely reduces in Manhattan, as shown in the graph below:

Source: https://www.castle-avenue.com/manhattan-condo-historical-price-trend.html

Even during the global financial crisis in 2008, property in Manhattan held its value very well (only slightly dipping, while values plummeted pretty much everywhere else in the USA).

You don’t need to buy something overly expensive to get on the property ladder… cheap flats in cheaper areas of towns are often great starting points.

I started small with property because it was all I could afford. My first apartment in Buenos Aires cost just $32,000 in 2006, then I paid about $75,000 for my next purchase in New Zealand two years later. The last property I purchased (a condo in West Village, New York) cost over $1,500,000.

Of course, I use a property management company to handle and maintain everything. I don’t touch anything myself. (That would be a full-time job in an of itself!)

SIDENOTE: Interestingly, these first two properties I purchased have both tripled in value since I bought them. This is called appreciation, and is one of the ways smart property investments will make you wealthier on complete auto-pilot.

2. Stock Investment

So Property is the first investment type in my Piggy Bank. The second investment vehicle I use is Stock Investments.

I’m a believer in the Jack Bogle (founder of the Vanguard Group, and the Vanguard Index Fund) approach to stock investing. I don’t try to beat the market, I simply buy all of it (via Index Funds) and have faith that over time the value will generally increase.

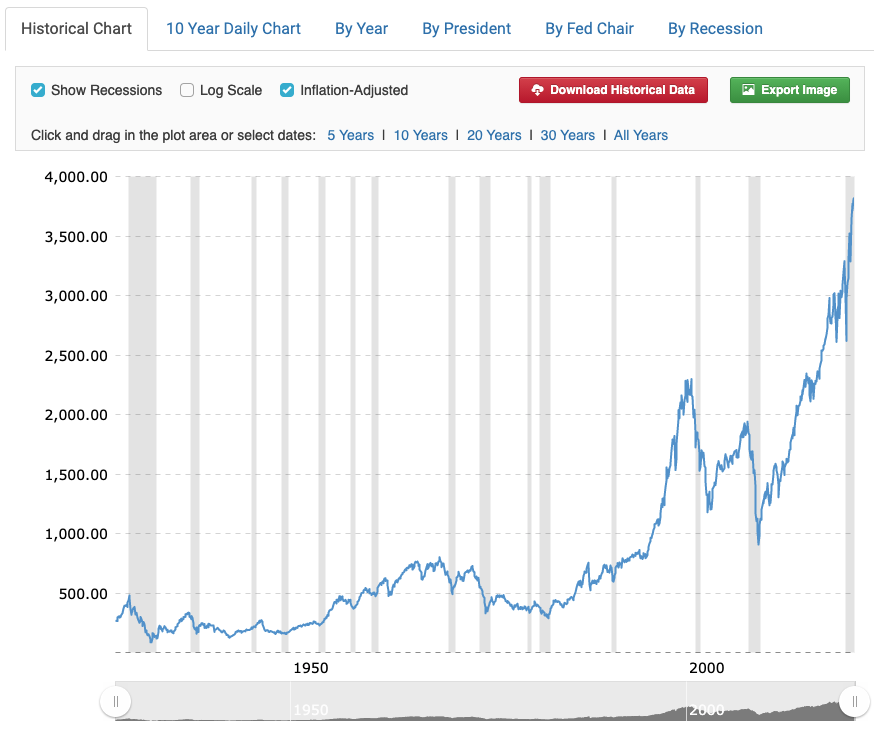

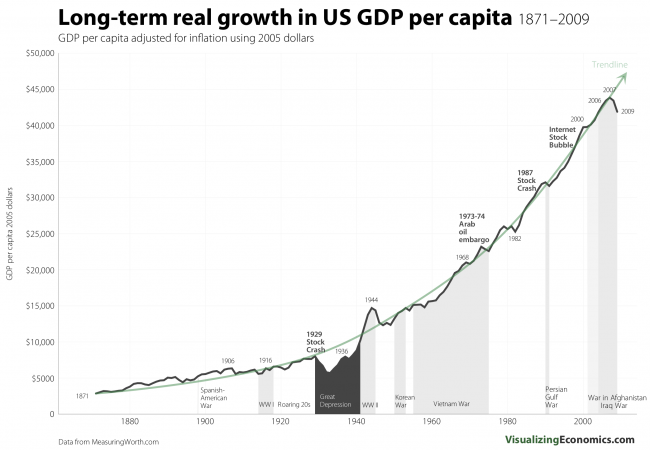

And increase is exactly what the market (as a whole) has done over the past 90 years, as shown below:

NOTE: The graph is adjusted for inflation (otherwise the growth line would be even steeper). The vertical grey lines are recessions. Note how the market has always bounced back after recessions.

And here’s what GDP growth in the USA has looked like over an even longer time-frame, 130 years (also adjusted for inflation):

It’s hard to argue with historic stats, and if you own all of the market (via index funds), then you get to participate in the overall performance of the market.

As with any kind of investment, it pays off to surround yourself with people who are smarter than you. I use a company called Creative Planning for all my stock investing, and they’re fantastic to deal with.

NOTE: Prior to working with Creative Planning, I did extensive research and had many many interviews with other wealth management firms. Creative Planning came out as my #1 choice by a long way.

My portfolio is made up of 100% stocks (diversified across different asset classes, currencies and markets, as discussed later), with 0% bonds. This makes my portfolio more volatile, but in the long run (if history is anything to go by!) it’ll result in higher returns. When I say I’m 100% focused on stocks, I am NOT in the game of stock picking. I invest in index funds and own a small slice of the entire market.

This approach of 100% stocks and 0% bonds is almost certainly not the best approach for most people.

One of the first things you should do when you start working with an investment adviser (like Creative Planning) should be to figure out what kind of asset allocation profile suits your needs, then move forward with that.

My profile consisting of 100% stocks works for me because I don’t have any expected need to withdraw funds in the near future, and have a long stock investing road ahead of me (hopefully). Again, for most people, choosing 100% stocks is not the right approach.

Will my Stock Investments grow in value every year?

No.

In fact, historical odds of making money in the USA markets are 50:50 over a 1 day period, 88% over a 10 year period, and 100% over a 20 year period. This assumes you keep your money IN the game and don’t remove it… but I think it makes a good point. Stock market growth is very reliable long term but NOT in the short term.

The trend over time is that the value of the market will grow (which means my portfolio value will grow), and I’m comfortable betting on the best companies in the world to grow overall… if they don’t, we’ll have far bigger things to worry about than investment portfolios and wealth building.

Appreciation in value is a big part of my Stock Investment plan, but passive income (via dividends) is also significant, and I plan for both.

Check my resource list at the end of this blog post to see my stock investment recommended reading and other resources for getting started.

3. The Casino

So far we’ve discussed The Mint, and ways you can make money to invest.

Next we discussed The Piggy Bank, and I shared my two low-risk investment strategies.

This section is about ‘The Casino’, and it’s where the fun really begins.

‘The Casino’ is the most exciting part of the Wealth Building plan because it’s where the action happens. This is the investment pool that’s high(er) risk and high(er) reward.

‘The Casino’ is the most exciting part of the Wealth Building plan because it’s where the action happens. This is the investment pool that’s high(er) risk and high(er) reward.

For the higher risk elements of my Wealth Building plan, I’m most comfortable betting on myself (rather than putting money into emerging markets, alternative investment funds, or businesses that I don’t really understand).

What this means is that for my ‘Casino’ category investments, I’m putting money (and time) into my own businesses, but more specifically, areas of my businesses or projects that have huge potential (but could also flop).

I have a couple of projects that fall into this category right now. One is a software tool that I’ve poured hundreds of thousands of dollars into, and the other is a project that is based around niche content creation. Either of these could completely flop or be sold in 5-10 years time for $50,000,000 to a company like GoDaddy.

My strike-out rate with Casino projects is higher than any of the other projects I’m running in my everyday businesses, and I’ve struck out many times over the past decade. But I’ve also accumulated a couple of big wins as well that make the strike-outs worthwhile.

If you compare Casino investments with Piggy Bank investments, the differences are massive. Piggy Bank investments are fairly predictable year in year out. You more or less know what you’re in for, what your upsides are, and also what your downsides are.

The Casino on the other hand is where hockey-stick growth happens.

These are the investments that could explode, or could completely crumble to nothing.

In terms of money, about 10% of my yearly investment capital is funneled into these ‘Casino’ projects, enough to keep me interested, but not so much that failure of a Casino project is going to derail my overall investment plans.

Money invested into Casino projects should be money that you can afford to lose, and just like with all investments, you should do as much as you can to mitigate risks.

What if you don’t have any big ideas to implement?

You don’t need an idea of your own, there are plenty of higher-risk higher-return investment options out there, any decent stock broker can help with this. Or alternatively, look for somebody else’s startup to invest in. Maybe you’ve got a friend with a good business who needs some funding. Or take a punt on crypto 🙂

SIDENOTE: I put cryptocurrency investments like Bitcoin in the Casino basket. This doesn’t mean that they’re unlikely to succeed, it just means that I don’t know enough about them to add them to my Piggy Bank investment bucket.

4. Parachute

So far we’ve discussed The Mint, The Piggy Bank, and The Casino, these are where money is made, invested and grows. But what if disaster strikes? What if the investments fail? What if there’s some world event (like a pandemic) that simply cannot be planned for?

This is where your safety net comes into play, I call it the Parachute.

The Parachute is designed to protect you and give you security if your investments fail, and also if your bread-and-butter income were to ever dry up.

Your Parachute should give you peace of mind, and let you sleep well at night. Here are a few suggestions:

A) Don’t Borrow Too Much Money

Not all debt is bad, in fact there are LOTS or times when it’s GOOD… the most common problem I see is when people are simply over-leveraged, when they’ve borrowed more than they can easily repay.

Being over-leveraged is a ticking time bomb, and the slightest curveball can bring everything tumbling down. If you’re not in debt (or not over-leveraged), then creditors can’t come knocking at your door asking for a repayment. Make sure your debt is limited to what you can easily service. If it’s too high (making it risky), then work hard to reduce it or think about refinancing.

In my case, I’ve worked hard to build an under-leveraged portfolio. This is a conservative approach to wealth building. I own my own homes in Argentina and New Zealand, and know that even if everything else went pear shaped, I have a roof over my head without the burden of a mortgage. Building under-leveraged wealth takes time, but in my opinion it’s worth it.

NOTE: Many investment advisors will tell you that owning your own home is the worst investment you can make. I understand the logic here, but for me it gives me peace of mind, which is also important. In saying this, if all the money you have is tied up in the home you live in, then you may want to consider how you can leverage this capital to your advantage (like lend against it to buy a rental property).

B) Low Overheads

There’s nothing sexy about this suggestion, but it’s common sense. Your ‘burn rate’ (rate at which you spend your money) should be well below what you make (your ‘earn-rate’). If you’ve got a high burn rate, then you’ll struggle to set aside money for investments. If your bread-and-butter income (day job) were to abruptly end, then a high burn-rate can be disastrous.

I’m fortunate to be in a position where I can buy almost anything I want. I could indulge in some expensive toys, but that’s not what makes me happy. I focus on experiences, they’re what make me happy. I have a very simple life, and a positive spin-off of this is that my overheads are kept pretty low.

C) Diversified Assets

The Piggy Bank shares two investment vehicles (Property and Stocks/Bonds) that work well as low-risk and fairly hands-off investments that perform over the long term. By using both, you’re already somewhat diversified, but you can get more diversified within those asset classes.

There are four important ways to diversify effectively:

1. Diversify Across Different Asset Classes

This is what we talk about in The Piggy Bank. Don’t put all your eggs in the property basket, or all of your eggs in the stocks bucket.

2. Diversify Within Asset Classes

Don’t only buy your favorite stocks or only invest in one type of property in one location.

I’ve done this with investment property by purchasing the following types:

- City center apartments in Auckland, New Zealand. Tenants are typically young professionals or students.

- Luxury condos in Manhattan, NYC. Tenants here are established professionals, typically with salaries of several hundred thousands annually.

- As well as my own residences in Argentina and New Zealand.

With stocks, I do it by buying Index Funds, which is a way to buy a small slice of the entire market (not just a favorite stock, like Apple).

3. Diversify Across Markets, Countries, and Currencies

As an example here, my Index Funds are not just focused on large USA companies (‘Large Cap Stocks’), but also Mid Cap Stocks, Small Cap Stocks, International Stocks, and Emerging Market Stocks (see definitions further below).

Other tradable indices include:

- Real Estate Investment Trusts

- Precious Metals (gold, silver, platinum, etc)

- Bonds

The image below shows the annual returns for selected asset classes since 2011:

Click the photo to enlarge.

Definitions as follows:

Large Cap Stocks are represented by the S&P 500 Index, which measures the performance of the large-cap segment of the U.S. equity universe.

Mid Cap Stocks are represented by the Russell Midcap Index, which measures the performance of the mid-cap segment of the U.S. equity universe.

Small Cap Stocks are represented by the Russell 2000 Index, which measures the performance of the small-cap segment of the U.S. equity universe. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

International Stocks are represented by the MSCI EAFE Index (Europe, Australasia, and Far East), which is a widely followed index of common stocks from 22 developed market countries.

Emerging Markets Stocks are represented by the MSCI Emerging Markets Stocks Index, which measures the performance of stocks in emerging market countries.

Real Estate is represented by the Dow Jones U.S. Select REIT Index, which measures the performance of U.S. publicly traded Real Estate Investment Trusts.

Precious Metals is represented by the MSCI World/Metals & Mining (TR Net) Index which measures the performance of U.S. stocks of companies engaged in the exploration and production of gold, silver and platinum-group metals.

Bonds are represented by the Barclays U.S. Aggregate Bond Index, which covers the USD-denominated, investment-grade, fixed-rate, taxable bond market. The index includes government and corporate securities, mortgage-backed securities, and asset-backed securities, with maturities of at least one year.

4. Diversify Across Time

Because we can’t time the market, you’re never going to know the right time to buy anything. But if you keep adding to your investment systematically over time (this is called ‘Dollar Cost Averaging’) you will reduce risk and increase returns over time.

As so many of the world’s greatest investors have shown, slowly accumulating investments over time can result in massive wealth.

D) Diversified Passive Income

If concentrating on a project (The Mint and/or Casino) is what will allow you to rapidly grow your wealth, it’s the diversification that will keep you wealthy. Building a passive income stream which is diversified from your day-job income should form part of your Parachute safety net.

This is one of the reasons that Piggy Bank investments should throw off some cash, and not only appreciate in value. Passive income is really important, and something you should look to build into your life.

Passive income has always fascinated me… the idea of income streams that work on autopilot has always been so appealing to me and I’ve focused on these as part of my overall portfolio. In my case, I could stop working on my businesses tomorrow and my diversified passive income would be plenty to live on.

E) Insurance

Insurance is the ultimate Parachute. It’s the kind of thing you pay for, but hope you’ll never need to use.

If you don’t already have insurance for your most important assets (for example, your home), then book a call with your Insurance broker to discuss it. Investing a little each month to protect yourself is a smart move!

To wrap up this section, I think the big thing for me is I’d rather be under-leveraged and live a lower-cost lifestyle than be over-leveraged with a high burn-rate. You need to figure out what you’re comfortable with, and apply that to your plan.

5. Foundation

The foundation is the glue that holds everything together.

My Wealth Building foundation includes:

- Legal Entity Setup

- Business Structure

- Asset Protection

- Accounting & Taxes

- Legal

- General Admin

If you get the Foundation well looked after, everything else will be simpler and more efficient. With the wrong setup or the wrong advisors, you could risk paying too many fees, being underprotected, and end up needing to invest too much of your own time on administrative tasks.

The perfect foundation will be different for almost everyone. For example, where you live has a huge bearing on what you can and can’t do, but the advisors you choose can be equally as impactful.

There’s no easy-button to getting your foundation right, and chances are as your investment portfolio changes and your needs change, you’ll make modifications to your Foundation (I’ve made multiple significant changes over the past decade). This is fine, in fact it’d be odd if you didn’t need to make strategic changes once in a while.

The good news about your wealth foundation is that when you’re starting out, it’s much simpler. For example, asset protection is less of an issue if you’re protecting $30,000 of assets compared to protecting $30,000,000. The same is true for legal and accounting, taxes and admin. Basically, every part of your wealth building plan will be simpler when you’re starting out. You’ve got room to make a few mistakes and feel your way a little.

It’s like learning to ride a bike, riding slowly with trainer wheels and a helmet has less risk than screaming down a hill without a helmet on.

Don’t let setting up the Foundation paralyze you. Move forward as best you can based on the knowledge you have and the advice you can get.

As a starting point in getting your Foundation right, I recommend you speak to a local accountant who understands your local laws. Explain that you’re going to be building up an investment over the years ahead, and need a simple business structure to house your operations. It doesn’t need to be perfect, you can always make changes later.

Putting Theory Into Practice

Now that you have a high level overview of the 5 pieces of the plan, let’s discuss the initial steps to get you going.

Step 1: Make Some Money & Set An Investment Goal

Figure out how you’re going to fund your investments. Do you already have cash you can use, or do you need to figure out a way to get some?

With so much upside to building an online business, I think everyone should consider this idea, as it could be an easy way to permanently solve the money conundrum.

The second thing to take care of in Step 1 is to decide on a yearly investment goal. How much are you going to inject into your wealth fund in your first year? What about your second year? Third year? And so on. Where will this money come from? It’s fine to start small and build up, just make a decision, write it down, and get to work on making the money you need to make.

Step 2: Make Your First Investment

You need to get in the game as soon as possible. If you’re on the sidelines, you’ve got zero chance of reaping the rewards of investment. If you treat investing seriously, and are not looking for a ‘quick win’, I firmly believe that it’s riskier to be on the sidelines than in the game.

If you’ve got enough cash available already (or access to capital), consider buying an investment property.

When I got started with property investment in New Zealand I hired a local ‘property coach’ to walk me through the local market, help me find a good deal, and to help me negotiate. This was probably the best $400 I have EVER spent. (I saved over $10k on the sales price by using the negotiation tactics my coach shared and more protected because of important ‘due diligence’ contract clauses I would never have known about otherwise).

Perhaps you can find a similar coach in your area, someone who is further along the property path than you are… consider investing some money in coaching. It’ll accelerate your results.

The key thing to remember when buying investment property is that you don’t want to buy a liability. Buy something that will appreciate in value AND put some money in your pocket each week. Don’t overcomplicate this, keep it simple.

If you don’t have cash available to buy a property, then get started by investing some money in stocks and bonds. There’s not really any lower limit to this, you could even get started with just a few hundred bucks. You’ll learn an enormous amount by simply creating a stock investment account and by being ‘in the game’.

Seek help from a wealth management company that:

- Is a fiduciary, meaning they are legally and ethically bound to always act in your best interest.

- Creates a customized plan to meet your needs.

- Does not sell their own mutual funds or hedge funds, as this is sure to present a conflict of interest. It’s better to work with a company that is not compensated when making recommendations.

- Is responsive to any questions you may have and supportive every step of the way.

As mentioned previously, I use CreativePlanning.com, and they’ve been fantastic.

Creative Planning won’t be right for most people however, as they have quite a large minimum investment amount to be able to work with them, but there are plenty of similar options out there that have no lower investment limit and offer many of the same benefits.

Check out this comprehensive list for some of the most reputable RIA (Registered Investment Advisor) companies in the USA:

https://www.barrons.com/report/top-financial-advisors/ria/2020

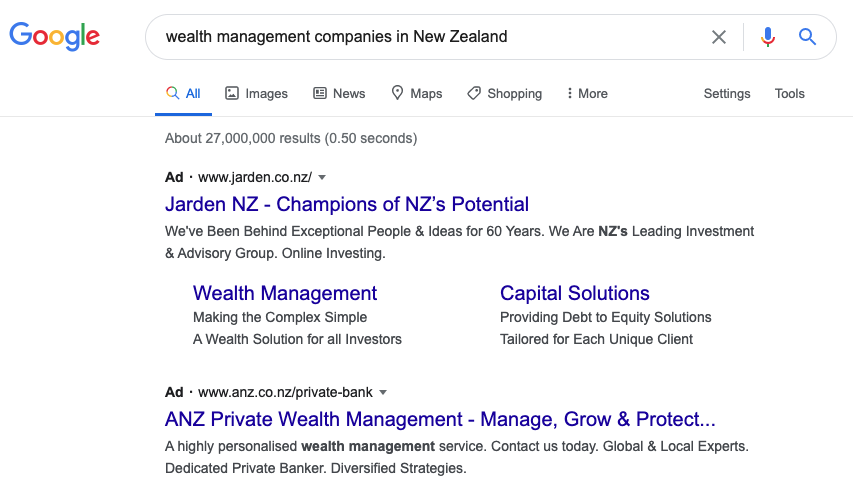

If you’re not in the USA, do a Google search for ‘Wealth Management Companies in [YOUR COUNTRY]’

For example:

Make contact with a few of them, and then pick one to get started with.

Once you’ve got this far, congratulations, you have already gone further down the wealth building path than most people ever go!

Step 3: Keep Working The Plan

The fastest way to grow your wealth is to have more money working for you. You can achieve this by pouring more money into your system.

Once your Mint and Piggy Bank are set up and running, and you’re confident that you can grow your fund with new cash injections periodically (monthly or yearly), think about what you can do to generate more investment cash.

Do you have a high-risk/high-reward idea (‘Casino’) you can throw into the mix and dedicate a small percentage of your time and funds to? If so, add that into your portfolio using a small percentage of your investment funds and money that you feel comfortable about losing.

Final Thoughts

To wrap this up, I’ll leave you with some final thoughts, things I’ve learned having put this into practice and in building several multi-million dollar businesses over the past 15 years.

- You can’t get truly wealthy working for someone else, but you CAN use a day-job to build a nice passive income and set yourself up with a nice nest egg if you’ve got a good investment plan in place.

- Most ‘high earners’ over-complicate their investment plan, or just don’t have one. I’d much rather be a low earner with a plan like the one I’ve shared here, than a high earner with no plan.

- When it comes to investments, magic bullets don’t exist. Don’t get caught up in the sideshow or the hunt for something that’s ‘too good to be true’, it probably is.

- Slow and steady wins the race. Accumulating small wins adds up big, especially when compounding is added into the equation.

- You can’t time the market (you can’t pick an optimum time to invest), and anyone that tells you you can doesn’t know what they’re talking about or has some hidden motive.

- The best time to start was yesterday, the next best time is today. I consider myself lucky to have discovered the world of investing at a relatively young age. In saying that, I’ve also seen first-hand how rapidly wealth can build. It doesn’t necessarily take a long time to see results, and you’d be amazed at how smart investments can grow in a few short years.

- Educate yourself continuously. There are so many smart people out there who share lifetimes of investment know-how for a few bucks. I’ve read some AMAZING books over the years from investment superstars, I’ll share a few resources with you at the end of this post to help get you started.

- Reward yourself. Stop to acknowledge the wins, even when they’re small.

- Be patient, good things take time. Results CAN be fast, but most likely they’ll be slow. Once your machine gets rolling, and once you hit a critical mass of funds, your wealth building will become unstoppable.

- Stay motivated. To implement and stick to a plan like this you need a strong reason why. Figure out what motivates you, and remind yourself of that often.

- Mindset, mindset, mindset… this is so critically important especially when it comes to investing. Refer to my Success Framework post to learn about my approach to systematic success.

Cool Tools & Formulas

To (hopefully) excite you about wealth building, here are a selection of cool tools, formulas and charts.

The Rule Of 72

The Rule of 72 is a rule of thumb that can help you find the approximate time it takes to double your investment given the rate of return. For example, at 9% p.a., it should take about 8 years to double your money.

The formula is 72 / 9 = 8.

If you have a 15% return, then the formula would look like this:

72 / 15 = 4.8 (meaning based on a 15% return, it’d take 4.8 years to double your investment).

Net Worth

Calculating your net worth requires you to take an inventory of what you own, as well as your outstanding debt. And when we say own, we include assets that you may still be paying for, such as a car or a house.

For example, if you have a mortgage on a house with a market value of $200,000 and the balance on your loan is $150,000, you can add $50,000 to your net worth.

Basically, the formula is:

ASSETS – LIABILITIES = NET WORTH

See more here: https://www.nerdwallet.com/article/finance/net-worth-calculator

Total Return

Working out your ‘Total Return’ is a simple calculation, but it reminds us that we need to include dividends (where appropriate) when figuring the return of a stock. Here’s the formula:

(Value of investment at the end of the year — Value of investment at beginning of the year) + Dividends ÷ Value of investment at beginning of the year

For example, if you bought a stock for $7,543 and it is now worth $8,876, you have an unrealized gain of $1,333. Assuming that you received dividends during this time of $350, you could find your total return using the following steps:

($8,876 – $7,543) + $350 ÷ $7,543

$1,333 + $350 ÷ $7,543

$1,683 ÷ $7,543

In this scenario, the total return would be 0.2231 or 22.31%. You can use this calculation for any period, which is a weakness since it doesn’t take into account the value of money over time.

See more here: https://www.thebalance.com/determine-return-on-investment-3140687

Simple Return

Simple return is similar to total return; however, it is used to calculate your return on an investment after you have sold it. You can find your simple return by using the following formula:

(Net Proceeds + Dividends) ÷ Cost Basis – 1

Let’s assume that you bought a stock for $3,000 and paid a $12 commission. Your cost basis would be $3,012. If you sell the stock for $4,000 (with another $12 commission), your net proceeds would be $3,988. Assuming your dividends amounted to $126, you could find out your simple return using the following steps:

$3,988 + $126 ÷ $3,012 – 1

$4,114 ÷ $3,012 – 1

1.36 – 1

In this scenario, the simple return would be 0.36 or 36%.

Like the total return calculation, the simple return tells you nothing about how long the investment was held. If you want to see after-tax returns, simply substitute net proceeds after taxes for the first variable and use an after-tax dividend number.

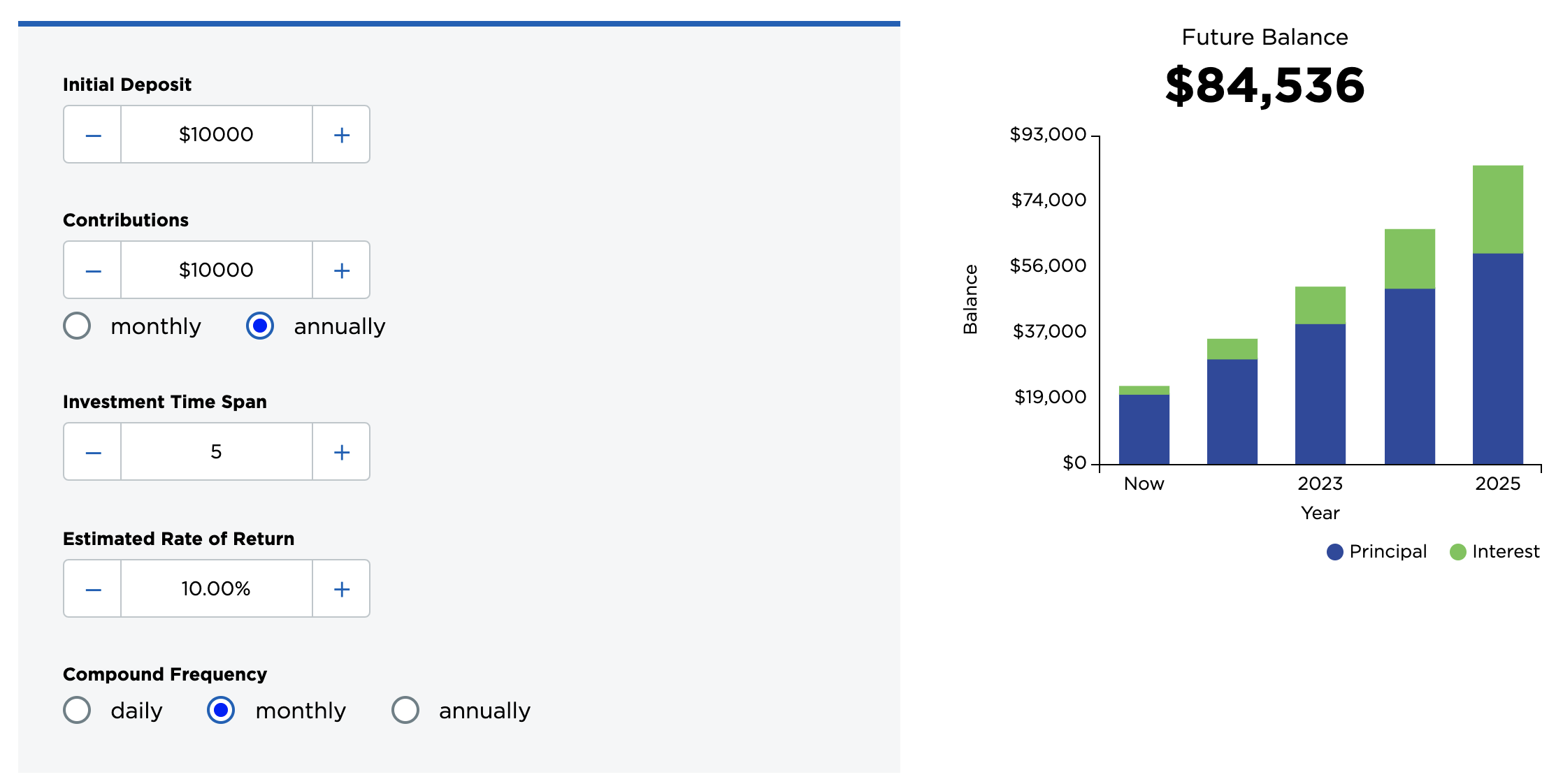

Compound Interest Calculator

There are dozens of these online…

You insert your initial deposit, set your annual or monthly contributions, investment time span, rate of return, and like magic you can see how your money compounds.

Here’s one example: https://www.nerdwallet.com/banking/calculator/compound-interest-calculator

Resources

In no particular order, here is a list of books and videos that I’ve read that have either motivated me or enlightened me in the world of investing and wealth building.

The Little Book of Common Sense Investing, by John (Jack) Bogle

The 5 Mistakes Every Investor Makes, by Peter Mallouk

Money: Master The Game, by Tony Robbins

Rich Dad Poor Dad, by Robert Kiyosaki

Principles: Life & Work, by Ray Dalio

How The Economic Machine Works, by Ray Dalio

Things The Rich Don’t Want You To Know, by Noah Kagan

The Richest Man In Babylon, by George Clason

Cashflow Quadrant, by Robert Kiyosaki

How To Get Rich, by Dennis Felix

The Intelligent Investor, by Benjamin Graham

How Rich People Think, by Steve Siebold

The Millionaire Next Door, by Thomas J. Stanley & William D. Danko

A Random Walk Down Wall Street, by Burton G. Malkiel

Unshakeable: Your Financial Freedom Playbook, by Tony Robbins

I Will Teach You To Be Rich, by Ramit Sethi

The Path, by Peter Mallouk and Tony Robbins

One Up On Wall Street, by Peter Lynch

The Psychology of Money, by Morgan Housel

Download The Infographic (PDF Format)

This is my wealth blueprint, but I know everybody has their own way of building for the future. Let me know your thoughts by leaving a comment below!

Thank you for the comprehensive guide, Aidan. Been saving extra to get started on investments for a few years now and I think am finally ready to start!

Awesome Donna!

Very inspiring! I’m a 22 year old still just starting with my financial journey, and my first big buy goal is a property. Hoping I get the same trajectory as your journey! Cheers

You’ve got a good runway ahead of you Ian, keep chipping away at it.

The Casino is truly the best part, but also the riskiest – kinda like a real casino! Been in the game for a little over 2 years, supporting startups here and there. Nice read, Aidan.

Yup.. I think you can still mitigate many of the ‘Casino’ risks.. and the rewards typically make them worth the gamble (in my experience).

Read all of this from start to finish and I feel like it really gave me a solid financial blueprint. Thank you Aidan Booth!!

So great to hear that Julius, thanks for the feedback!!!

When the pandemic hit I started to really think about my finances seriously. In 2020 I started to save some money and this year I think I’m finally ready to dip my toes into investing! This is one good resource for a beginner like me. Thanks aidan

No time like the present!

Which Vanguard Funds for the stock investment portion and in what percentages?

I don’t actually use the Vanguard index, not that it really matters, because I buy the whole market through a range of different indices anyway… unsure on what the current percentages are, that’s the beauty of working with advisors who I can trust 100%, and simply turn things over to them. I haven’t checked the specific breakdown since we began working with one another. I will say that the portfolio is rebalanced periodically, so the exposure to each asset class remains fairly constant.

That was a very comprehensive write up Aidan. Thank you so much! Will definitely keep this in mind through this new journey ?

Great to hear Anita, best of luck